In uncertain times, people often seek certainty. However, when it comes to financial modeling for reserve funds, associations should consider the unpredictability of the capital markets and focus on sound portfolio management policies.

It is said that in the summer of 1913 in the small nation of Monaco, a statistically improbable event occurred at the Casino de Monte Carlo that cost gamblers millions. Roulette players watched in disbelief as the ball landed on black 26 consecutive times. Since a roulette wheel has only two colors (red and black) that are equally distributed, opportunistic gamblers started betting heavily on red, reasoning that the odds would ultimately catch up to the wheel. The odds almost certainly did catch up, but by then it was too late for the gamblers as the wheel had wiped them out before the reversion to the mean occurred.

Of course, investing institutional assets is far less reliant on tuxedos, sequin gowns, martinis, and wheel spins. Associations need to be prepared for some uncertainty like in Monte Carlo, and a well-thought out plan can position them for the best outcomes in these volatile times.

Understanding the Unpredictability

The most prudent fiduciaries build an investment policy that takes into account potential inflows, outflows, and any required rate of return. Portfolios are then built with the goal of achieving returns with the least portfolio risk. If your return objective is 5 percent, the ideal asset allocation uses the least volatility to achieve it.

The process is thoughtful, mathematical, and anything but certain. In order to project how a portfolio might perform over the next three, five, or 10 years, you need to make some assumptions on how the underlying components of that portfolio will perform. Put another way, two investors targeting a 5 percent return are going to have very different portfolios if one believes stocks will earn 20 percent and another believes they’ll return 2 percent.

These inputs become the key determinant of a portfolio’s asset allocation structure and, consequently, ultimate portfolio performance. The pattern of returns is a key culprit of the uncertainty. Even if we magically received data from the future that listed capital market returns for the next 10 years, we couldn’t predict the pattern of those returns over that period. Those patterns, unfortunately, can be important.

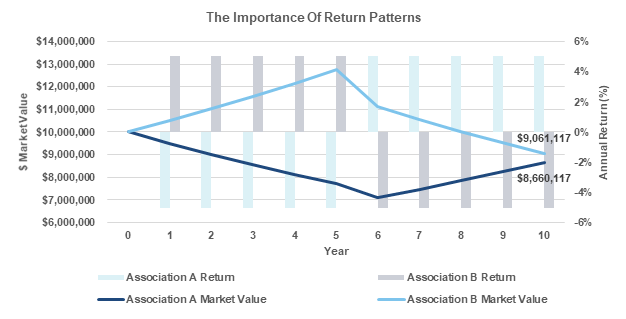

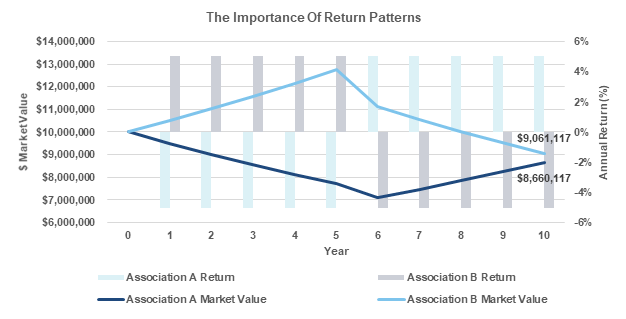

Consider the following example that looks at two hypothetical associations planning to make a 10-year investment. Each begins with an initial balance of $10 million. Each will withdraw $1 million after year five. After 10 years, each had the exact same calculated portfolio return and risk. Yet, one of them had $400,000 more in ending portfolio value. How is this possible?

Past performance is not indicative of future performance.

The two associations experienced return patterns that were mirror images of one another. Since Association B’s best years occurred near the beginning, they were better prepared to handle the cash outflow and, consequently, finished with higher asset values. Association A’s worst returns came at the beginning—their roulette ball kept landing on black—and their cash outflow wasn’t around to see the odds change.

Prudent fiduciaries understand that growth investing is filled with uncertainty and offers little by way of guarantees.

Simulations Can Help

Associations rarely deposit sums of money that are untouched for 10 years, particularly those with defined spending and cash flow needs (including any related endowment or foundation). This makes accounting for the potential future patterns of returns an important consideration. But how to do that?

A tool called Monte Carlo Simulation allows investors to take an investment balance, factor in an expected level of portfolio return and volatility, incorporate a spending rate or known/potential cash flows, factor in inflation, and then … spin the wheel.

The Monte Carlo Simulation then randomizes thousands of different potential patterns of returns, calculates the impact to asset values, and organizes simulated results into probability percentiles. It’s not perfect—and certainly not guaranteed—but it is a tool that allows the investor, at the outset, to compare and contrast different investment strategies or simply answer questions like “What is the probability that we will lose money in the near/long term?”

Prudent fiduciaries understand that growth investing is filled with uncertainty and offers little by way of guarantees. However, they also recognize that fiduciary duties of care don’t require or expect guarantees. They do require that investment strategies are backed by sound and defensible reasoning. Monte Carlo Simulations can be a valuable tool in that regard. In fact, it may be the one instance where regulators are OK with investment fiduciaries “spinning the wheel.”

The content of this article has been obtained from a variety of sources that are believed, though not guaranteed, to be accurate. Opinions expressed do not necessarily represent the views DiMeo Schneider & Associates, L.L.C. The content does not represent a specific investment recommendation. Please consult with your advisor, attorney, and accountant, as appropriate, regarding specific advice. Past Performance does not indicate future performance.