Accumulating healthy investment reserves is an objective of most associations. But not fully understanding all the fees associated with investing those reserves can present a serious fiduciary risk.

Chances are, you could state-—to the penny—what you paid in occupancy costs last month. Could you do the same for your investment fees? Fees associated with investment portfolios are multidimensional and not always as transparent as they could be. A key component to fulfilling your fiduciary duty to ensure that fees are “fair and reasonable” is to understand all the underlying components, and how they are collected.

The Different Components

If you have an investment portfolio, you are, in some form or another, paying one or more of these fees:

Investment advisory. Investment advisors help you set investment policy and strategy. They also assist in selecting the underlying investments in the portfolio and meet with you regularly to communicate investment results versus policy objectives. While sometimes collecting a flat fee for their services, most are compensated as a percentage of assets under management. (The upcoming 2019 edition of the ASAE Foundation’s Association Investment Policies, Practices, and Performance notes that nearly 80 percent of associations do so in this manner.)

Investment management. The investment manager makes the buy/sell decisions on individual securities for the portfolio. This can take the form of a separate account manager, but mutual funds are the most common investment management vehicle used by associations. The fee paid to the investment manager is on top of anything the investment advisor collects and is often deducted directly from the value of the investment, not as a separate line item, which makes it difficult to track. With mutual funds, this fee is commonly defined as an “expense ratio.”

Custody. The custodian is the entity responsible for safeguarding and reporting a value on securities you own. They provide you with a monthly statement of value and all associated activity (e.g., dividends, interest, realized gains, and so forth). Custody accounts typically are paid by charging commissions when they buy and sell securities on your association’s behalf.

Common Miscues and Pitfalls

Even those associations that are comfortable with their knowledge of investment costs are prone to mistakes. Here are a few examples:

Investment advisory. While the most transparent way to compensate your investment advisor is through a separate payment, sometimes the advisor also gets indirectly compensated by the investment manager(s). Also known as a 12b-1 fee, this cost is incorporated into the overall expense ratio of a mutual fund. This creates a tracking problem and a fiduciary challenge. Since different funds come in different share classes, and those share classes can pay different amounts to the advisor, an association must ensure the advisor is not just recommending funds that provide them the highest compensation.

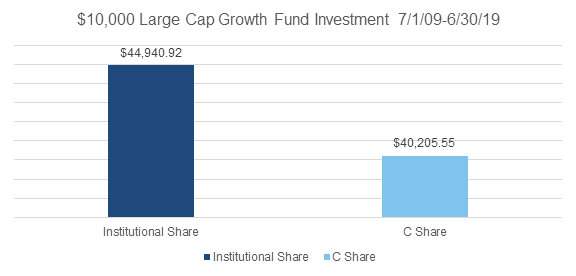

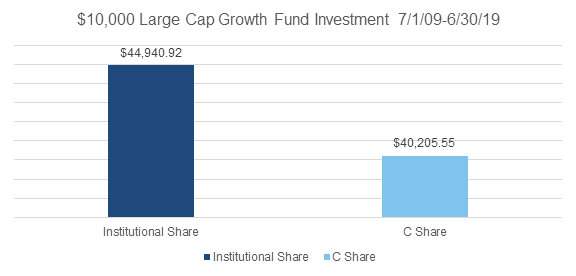

Investment management. Investments that have underlying expense ratios deducted from an investor’s fund value make fees difficult to track. Further complicating things is that the same fund can be offered in different share classes. In the illustration below, two hypothetical associations invest an identical amount at an identical time in an identical mutual fund. However, one association chooses the low-cost institutional share class, while the other uses the more costly “C” share. After 10 years, the institutional share association has meaningfully more dollars than its colleague invested in the “C” share.

Data Source: Schwab Advisor Services. This graph represents the growth of a hypothetical investment of $10,000 in MALHX and MCLHX, respectively. It assumes reinvestment of dividends and capital gains, and does not reflect sales loads, redemption fees or the effects of taxes on any capital gains and/or distributions.

In defense of our hypothetical “uninformed” association, using a higher-cost share class can sometimes be due to a lack of options versus a lack of information. Institutional share classes are priced lower because they carry higher investment minimums; it may be that the association is not “uninformed” at all, but simply has less money to invest. Importantly, there are a variety of ways these higher institutional investment minimums can be reduced (or even waived), such as leveraging the collective buying power of a particular custodian. All associations should explore these opportunities as appropriate.

Custody. While simple custodial needs can be satisfied at a nominal cost, many investors are lulled into the fallacy that custody is in fact a “free lunch.” It is not. Custodians are going to be compensated—either through a direct fee, transactions/commissions, proprietary funds, payment from a nonproprietary fund, or through deposit sweep assets. Sometimes the custodian is the same entity as the investment advisor and/or investment manager, in which case overall firm revenues are used to cover custody. This is not to say that any of these compensation models are “wrong” per se, only that they should be fully understood by the investor.

Like any other operating expenses incurred, thoughtful associations do not immediately opt for the approach that appears lowest cost. However, as prudent fiduciaries, associations should understand all the costs associated with their investment reserves as well as the services being provided. That’s not just smart investing; its smart business.

The content of this article has been obtained from a variety of sources that are believed, though not guaranteed, to be accurate. Opinions expressed do not necessarily represent the views DiMeo Schneider & Associates, L.L.C. The content does not represent a specific investment recommendation. Please consult with your advisor, attorney, and accountant, as appropriate, regarding specific advice. Past Performance does not indicate future performance.