Dennis Gogarty

Dennis Gogarty, CFP, AIF, is president of Raffa Wealth Management in Washington, DC, and vice chair of ASAE’s Finance and Business Operations Professionals Advisory Council.

A new investment benchmarking report from Raffa Wealth Management has clear takeaways for associations looking to manage their reserve funds wisely.

Associations and their boards have a fiduciary responsibility to be good stewards of their organizations' assets, and one way to do that is by making sound investments. Still, many associations plan their investment policies and gauge their investment performance in a vacuum, without helpful benchmarks showing how similar associations manage their reserves and perform on their investments.

To fill that knowledge gap, Raffa Wealth Management publishes its annual Study on Nonprofit Investing [PDF] to track how nonprofits invest their reserves and how their investments perform, with an ultimate aim of helping nonprofits benchmark their own investments. This year more than 700 nonprofits, including associations, public charities, and private foundations, participated. Here are some of the most interesting findings and four takeaways for associations.

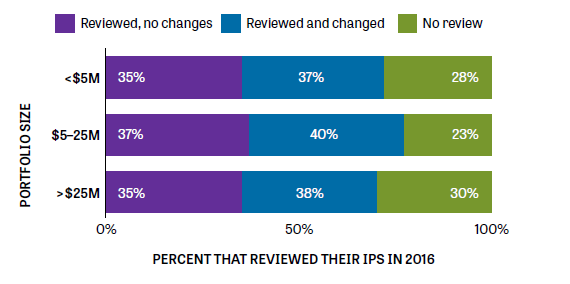

1. Review your association's investment policy statement. Approximately 70 percent of associations reported that they reviewed their investment policies at some point in 2016. About half of those indicated that they made some change. Although it's important for associations to review their investment policies on an annual basis, it's especially important to do so when the association experiences turnover among key staff or volunteers, or if there are changes to the association's financial condition. Leadership turnover can trigger a change in the willingness (or conversely, the aversion) of the organization to take on investment risk, so it is important for the association's policy to accurately reflect such changes. Similarly, any change in the association's financial condition, be it for better or worse, effects the organization's ability to take on more or less risk. For example, if your association's revenue stream has taken a hit over the last few years (say, membership reenrollment has dropped significantly), you may want to adjust your investment policy to reflect a more conservative risk posture. Also, be sure to review your policy with your board or investment committee and your investment advisor to determine if updates need to be made.

2. Create a benchmark to objectively evaluate your investment advisor. Many associations in this year's survey expressed uncertainly about how to evaluate the effectiveness of their investment advisors. The key is to develop a high-level blended policy benchmark (BPB). The BPB is a mix of indexes based on the policies outlined in your association's investment policy (for example, the target asset allocation to US stocks, foreign stocks, bonds, and cash). The performance of the BPB is the baseline performance expectation of the portfolio based on market conditions and absent professional advice. Just as in a scientific experiment, the BPB serves as the control. Comparison to that control reflects the gain or loss resulting from any investment strategy decision or judgement. It's critical that your BPB remains constant unless the organization, not the advisor, directs changes to your investment policy statement. If your association's BPB changes to reflect an investment judgment or a change in an advisor's strategy, then comparing your results to your BPB no longer reflects the value of those decisions.

Many associations plan their investment policies and gauge their investment performance in a vacuum, without helpful benchmarks showing how similar associations manage their reserves and perform on their investments.

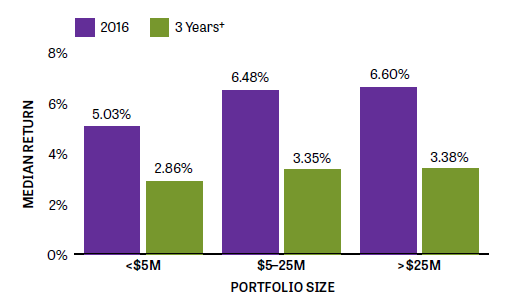

3. Compare your association investment returns with others. To determine whether your association's investments are performing in line with your peers, it's critical to compare your returns. The median association reported that its long-term reserve earned* in the 5 percent to 6.6 percent range, depending on budget size, for year-end 2016. Performance that falls outside of this range might be acceptable, but after comparing your returns, consider connecting with your advisor to understand why. Over the last three years, ending December 2016, annual returns* of approximately 3 percent were typical for associations that participated in the study, with larger, more equity-heavy portfolios performing better. This was expected given market conditions, which have favored stocks over bonds.

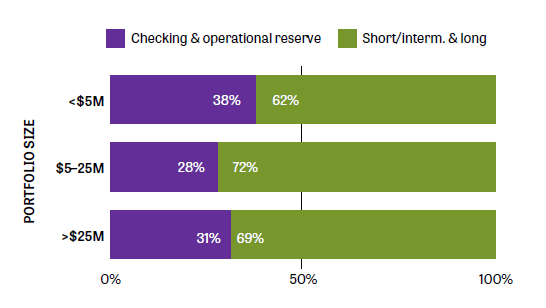

4. Put your association's excess cash to work. When asked to segment their total liquid assets between cash-in-hand versus assets invested for longer-term objectives, the median association reported a 30-70 percent split. This means that the median association deploys about 70 percent of its total liquid cash to short, intermediate, or longer-term investments, leaving the remaining 30 percent in a checking or operational account. All associations can benefit by maintaining policies to make better use of their excess cash. Ultra-short-term or short-term bond mutual funds, possibly balanced with a small allocation to stocks, can serve as an ideal middle ground before excess cash is allocated to longer-term strategies.

Associations that regularly review their reserve policies and performance, objectively evaluate their advisor, compare investment returns, and put excess funds to work should be positioned to make better-informed decisions about their investments.

*Survey participant responses, including investment performance, have not been verified or audited. All performance data cited is as of December 31, 2016.

The views expressed herein are opinions reflecting the best professional judgment of Raffa Wealth Management, LLC. This report is for informational purposes only. The information contained has been gathered from sources we believe to be reliable, but we do not guarantee the accuracy or completeness of such information. Data analysis was performed by Raffa Wealth Management. When stating "nonprofit" or "association" responses it should be noted that all responses are limited to the nonprofits that participated in the survey. No broader indications should be assumed. There can be no assurance that the future performance of any specific investment or investment strategy referenced in this article will be profitable, equal any corresponding indicated historical performance level(s), or be suitable for your nonprofit's portfolio. Any investment can lose value.